Issue an invoice via the web and send it to partners as well. Electronic data such as PDFs

e-Tax Invoice is part of the Thai government's electronic service. “e-service” In June 2017, the Revenue Department announced the policy of electronic tax invoices (e-Tax Invoices) and filing preparation.

Storage of electronic receipts (e-Receipts) To issue tax invoices or electronic receipts, secure and reliable hardware and software are required in a manner consistent with electronic transaction laws. Many organizations see the benefit of changing the way they operate. about invoices and receipts with analog documents as a electronics and are imported or even an organization that needs to be traded keep in touch as well It is expected that from now on, various organizations in Thailand will begin to turn to more digital

Before using E - tax : problems from issuing invoices with paper

1. There are expenses, paper costs, document copying fees.

Invoice document transportation cost

2. Wastes document storage space and human resources to search for documents.

3. Waste of time

- Signed and approved with a signature

- Create Data

- Delivery of the Revenue Department

Advantages of converting your Tax Invoice to Electronic

Advantage 1 : Save time and cost in sending documents invoice type

In that paper operation…

Many organizations issue tens of thousands of invoices each month.

The person responsible for such work in the company must carry the documents for delivery. or need a messenger

send to Those operations were a waste of both time and labor. may not be delivered to the recipient immediately

But if switched to electronic... It will help reduce the cost of transporting documents and time can go down

When these invoices become electronic can be sent by email

This reduces the time and cost of document delivery. It not only saves time and

Expenses can also send billing information to your business partners in real time.

Benefit 2 : Reduces document storage space and the labor of searching for documents.

In Thailand, invoices issued to various agencies must be kept for a specified period of time (Tax invoices, which are VAT documents, must be kept for at least 5 years).

If these documents are issued in paper form The amount of paper to be stored can be enormous. Because just one case may require multiple documents.

. It is necessary to search from a large pile of papers. Many companies require a large amount of labor to operate. , but switching to electronic…will reduce document storage and document “Electronicization” reduces the paper resource. This eliminates the need for space to store large amounts of paper. In addition, there is no need for file folders or paper

Benefit 3 : Makes Paperless a reality

This is because a large amount of paper is used for printing documents. both the part that must be delivered to the business partner and the part that must be copied and kept in the company Thus, it has become a huge expense in the supply of paper that the company is responsible for.

large amount of paper usage in addition to having to bear the cost It's also not environmentally friendly.

But if switched to electronic ... will make Paperless really happen.

Reduce printing to paper can reduce the cost of paper costs

The concept of saving the planet is gaining momentum. From now on, Thailand will enter an era where various work processes must pay attention to the environment as well.

Advantage 4 : Signed and Approved Electronically

For invoice signing, it must be done from the original form in the office. If the signatory has to travel or work upcountry or abroad Accelerated signing may not be possible.

especially during the monthly closing Quite a few people involved did not have the time to verify the accuracy of the content. It becomes a hassle if it is not signed.

But if switched to electronic…can be signed or approved at any time.

Electronicization eliminates the need for handwritten signatures on paper.

What is Cloud service e-Tax Invoice?

Pros of e-Tax Invoice

Cloud service does not require much investment.

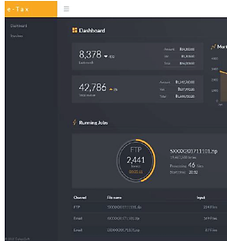

It has a very flexible document search function. including visual dashboard functions easily on a platform that can support big data

Reduce costs and working hours

high level of security

can be operated between the organization and the Revenue Department and trading partners through electronic channels Safe with ISO 27001-compliant platforms and methods of operation.

This reduces the cost of equipment investment in the company and reduces a large number of operational costs in the process. Billing and managing and storing data on paper

What can be done using the e-Tax Invoice digital platform

-

It can turn the work and approval processing for Tax Invoice and other documents electronically as required by the Thai government.

-

Send and receive secure data using digital data. between government or business partners

-

Store your Tax Invoice and other documents in Secure Storage and use the document search and management functions.

-

Able to support the approval process before submitting documents to business partners or the Revenue Department

-

Dashboard functionality to manage the amount of document data and delivery situations.

Functions and strengths of the e-Tax Invoice digital platform

-

Flexible data interface with ERP or accounting system

-

Support even if there is no ERP or accounting system

-

It works in full compliance with the IRS XML file specification.

-

Automatically upload XML in finance via RPA (Robotic Process Automation) (optional).

-

Store electronic data in Data storage that is secure according to the Revenue Department's regulations.

-

Set up notification function Automatic sharing of information to partners or customers.

-

Support the work of approval before the document is sent out. to partners or the IRS, as well as issuing documents by paper

-

Enhance search functionality by using keywords in your content. All in a document, status, e-Tax data is visible , with sophisticated dashboards.

-

Security in electronic data and transaction processing complies with ISO27001 standard.